Credit cards can be a convenient and powerful financial tool, but they can also be a source of financial trouble if they are not used wisely. In this article, we will explore some of the best practices for using credit cards to help you make the most of this powerful financial tool while avoiding the pitfalls that can lead to financial trouble.

First and foremost, it is essential to understand the basics of credit cards. A credit card is a type of loan that allows you to borrow money to make purchases. When you make a purchase with a credit card, you are borrowing money from the credit card issuer. You will then be required to pay back the borrowed amount, plus interest, over time.

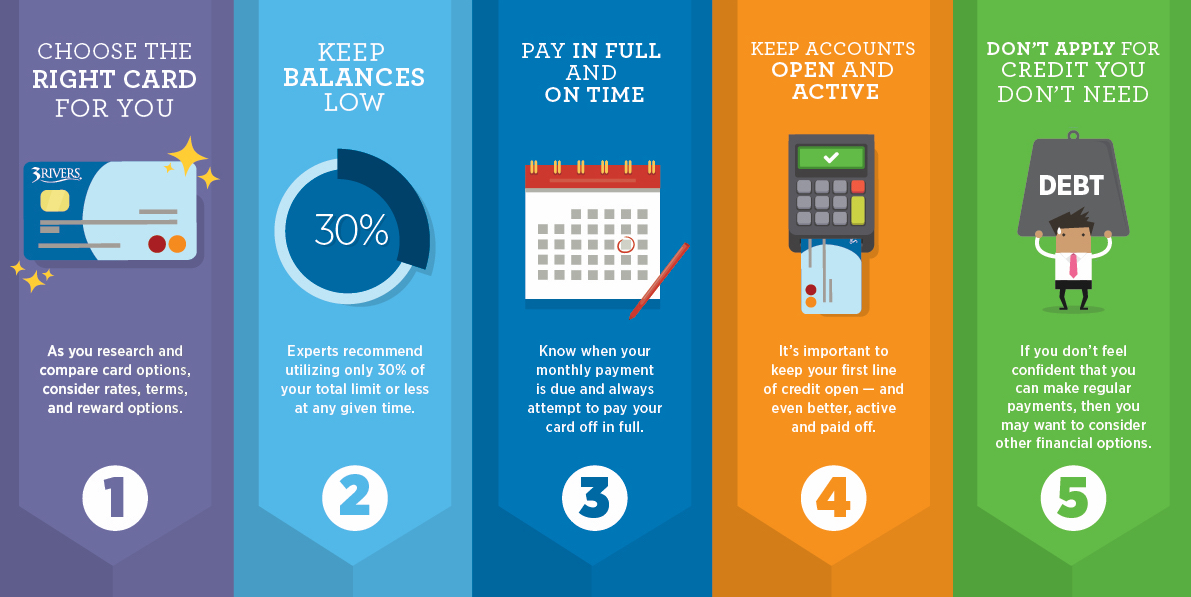

The key to using credit cards wisely is to always pay off your balance in full each month. This will prevent you from accruing interest charges, which can add up quickly and make it difficult to pay off your balance. Additionally, it’s important to avoid using more than 30% of your credit limit as it can hurt your credit score.

Another important practice is to be mindful of the fees associated with your credit card. Some credit cards charge annual fees, balance transfer fees, cash advance fees, and other types of fees. Be sure to read the terms and conditions of your credit card carefully to understand all of the fees that may apply.

When choosing a credit card, it is important to consider the rewards and benefits that are offered. Many credit cards offer rewards such as cashback, travel miles, or points for purchases. These rewards can be a great way to earn extra money or save money on travel and other expenses. However, it is important to compare the rewards and benefits of different credit cards and choose one that offers the best value for your needs.

Another important practice is to monitor your credit card statements closely. This will help you stay on top of your spending and ensure that you are aware of any suspicious or fraudulent activity on your account. Be sure to report any suspicious or fraudulent activity to your credit card issuer immediately.

It is also important to be aware of the impact that credit cards can have on your credit score. Your credit score is a numerical representation of your creditworthiness, and it is used by lenders to determine the terms and conditions of loans and other financial products. A good credit score can open doors to better interest rates, lower fees, and more favorable terms.

To maintain a good credit score, it is important to make timely payments and keep your credit card balances low. Late payments and high credit card balances can have a negative impact on your credit score. Additionally, it’s important to keep your credit card accounts open, as closing an account can also have a negative impact on your credit score.

Another important practice is to be mindful of the interest rate of your credit card. Interest rates can vary widely among credit cards, so it is important to compare the interest rates of different credit cards and choose one that offers the best rate for your needs.

In conclusion, credit cards can be a powerful financial tool, but they can also be a source of financial trouble if they are not used wisely. By understanding the basics of credit cards, being mindful of the fees associated with your credit card, choosing a credit card with the best rewards and benefits, monitoring your credit card statements closely, being aware of the impact that credit cards can have on your credit score, and being mindful of the interest rate of your credit card, you can make the most of this powerful financial tool while avoiding the pitfalls that can lead to financial trouble.